Our Services

Precision-driven consulting for your business's financial management and compliance needs.

Comprehensive Accounting Services

Tailored accounting solutions to enhance your financial operations and reporting accuracy.

Business Registration Support

Streamlined registration services to help your business comply with local regulations efficiently.

Statutory Compliance Management

Expert guidance to ensure your business meets all statutory compliance requirements seamlessly.

Accounting & Compliance

Ensure accurate financial management and adhere to all regulatory requirements with expert accounting and compliance services.

Accounting & Bookkeeping

Internal Audit

Certification

Project Reports

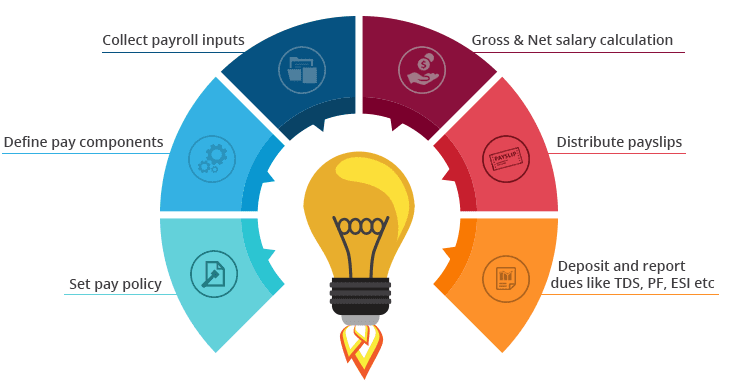

Payroll Management

Tally Training

Business Registration

Simplify and expedite your business setup by managing all necessary legal registrations and formalities, ensuring your operations start on a compliant foundation.

MSME Registration

IEC Code Registration

Shops & Establishment

Trade License (Bangalore)

Professional Tax Registration

FSSAI Registration

PAN Registration

NGO Registration

LLP Registration

CSR Registration

12A & 80G

Partnership Firm Registration

Company Incorporation

Tax Filing

Timely and precise preparation and submission of tax returns, ensuring compliance with tax laws and minimizing risks of penalties or audits.

Income Tax Filing

GST Filing

TDS Filing

PT Filing

PF Filing

ESI Filing

Digital Signature - DSC

Frequently asked questions

GST

GST (Goods and Services Tax) is a unified, comprehensive tax levied on the supply of goods and services across India, replacing multiple indirect taxes and making compliance simpler for businesses and consumers

GST Filing

GST filing is the process through which registered businesses submit regular returns to the tax authorities, reporting their sales, purchases, and tax paid/collected for a given period. It ensures compliance and allows businesses to claim input tax credits

TDS

TDS (Tax Deducted at Source) is a system where a specified percentage of tax is deducted by the payer at the time of making certain payments (like salary, interest, or professional fees) and is deposited with the government, reducing the risk of tax evasion

ESI

ESI (Employees’ State Insurance) is a government-run social security scheme providing medical and financial benefits to employees and their families in case of sickness, maternity, disability, or employment injury. It is mandatory for eligible employers with the prescribed number of employees

NGO Registration

NGO registration in India is the legal process of establishing a non-profit entity—Trust, Society, or Section 8 Company—granting it official recognition to operate for charitable or social empowerment purposes

12A & 80G

12A registration offers NGOs tax exemption on their income, while 80G registration allows donors to claim deductions on donations made to the NGO. Both are essential for non-profits seeking tax benefits and credibility

Address

No. 25, 1st Floor, Laxmipati Layout,

Kariyannapalya, Lingarajapuram,

Bengaluru, Karnataka – 560084

Landmark: Behind Dr. S. R. Chandrasekhar Institute of Speech and Hearing

Contact

+91 97387- 68945

kumar@renderingcaesar.com